Category: Technical Analysis

-

Setting the Stage By Denaliguide Scroll down to see the interview Markets rise and fall like the ocean’s tide. Sometimes the pull is gentle, other times it’s a surge that sweeps away anyone not anchored. Since 2012, I’ve noticed that these tidal-like cycles have grown more powerful. They are recurring waves of speculation and investing.…

-

Breakout Stock Spotlight: When Trading Ranges Erupt Have you ever heard the terms “trading range” and “breakout stock” in the same breath? That’s because one often leads to the other. And when it does, things can move fast. What Is a Trading Range? A trading range is the zone between a stock’s typical upper and…

-

Gold Juniors Crushed In the volatile world of mining stocks, there’s a saying that’s ringing loud and clear right now: “Gold sneezes, and the Junior miners catch pneumonia.” And it’s never been more true. What Are Junior Gold Miners, Anyway? Junior gold miners aren’t the giants like Barrick or Newmont. They’re not even mid-tier producers.…

-

📈 NO-DIRT STREAMER: A First Look at Royalty Streaming Let’s start with the basics:Mining for gold or silver is pretty straightforward—you dig in the dirt, haul it up, and pour chemicals over the crushed rock to separate out the good stuff. But with royalty streaming, you don’t dig.You don’t pour chemicals.You don’t move a speck…

-

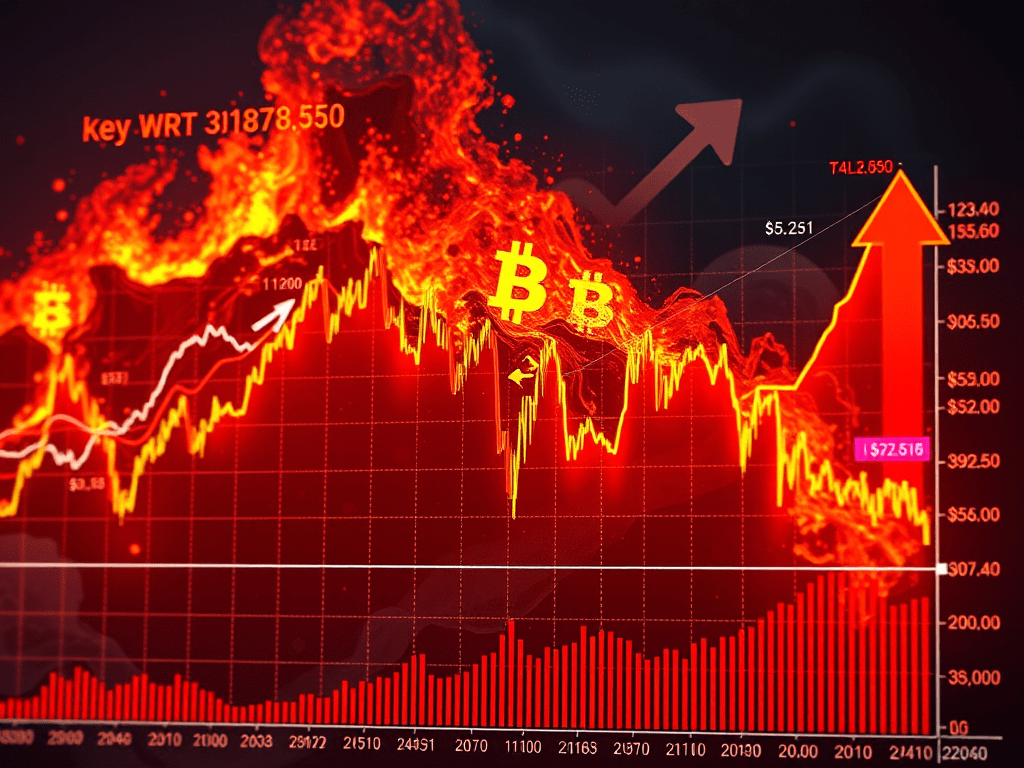

Dec 31, 2020 Did any of this make any sense to me? In the greater part, I was incredulous at the insane valuations of the DJIA style markets. First on the left is the DOW, on the right is the Average Stock that you or I might own. Did you notice they went up…

-

WHAT DOES A TRIP-WIRE LOOK LIKE ? It’s as clear as a bright sunny dawn, that multiple financial failures are what is draining all the cash the FED is putting out as repo’s. That’s probably not the sun you see coming over the horizon but the closest nuclear meltdown of a bank or derivatives…

-

TECH TALK TUESDAY OCT 8, 2019 Red in this chart is the 50 day simple moving average. Blue on this chart is a 20 day simple moving average. I call this a Double Crescent Formation. This is an example of a “price” set up, with the two moving averages in upturning crescents. On-Balance-Volume in…

-

For most of us the reason for price movements, can be pretty masked most of the time. This latest weakness in Gold, has a clear reference to China, as shown in this LINK , based on China’s vacation week, its National Days which ended today. The charts in the linked article give graphic representation…

-

TECH TALK TUESDAY September 24, 2019 How to use some measures RELATIVE STRENGTH INDEX Pretty much this index is either mis-used or over-used. Commonly when RSI is in the upper or lower level it is called, either Over-Bought or Over-Sold, which are both very inexact and can be terribly misleading. Labelling a…