scroll down for the video

We talk a lot about buying.

We talk about “breakouts,” and “opportunities,” and “the next big thing.”

We talk about where the market is going — and what might go up.

But there is a quieter, harder, and far more important question that rarely gets the same attention:

When should you sell?

Because buying may feel like investing —

but selling is where investing becomes real.

The Contract We Don’t Like to Talk About

Every investment is, at heart, an aleatory contract.

A wager with uncertainty built into its bones.

You place your capital into the hands of time, chance, and discipline. You hope that you will recover more than you put in.

Sometimes you do.

Sometimes you don’t.

Gerald Loeb once answered the question “When should one invest?” with perfect simplicity:

“When you have the funds.”

But the more honest — and more difficult — question comes later:

When do you step off the ride?

The Market Whispers First

Markets do not shout their warnings.

They whisper.

Long before a company admits trouble.

Long before headlines change their tone.

Long before fear reaches the crowd.

The stock already knows.

And it shows that knowledge quietly — through price, momentum, and trend.

Listening to the Numbers

A good place to begin is what I call the three S’s:

Sector.

Is the broader sector still being invited forward — or is it beginning to stall?

Selection.

Is your specific stock still leading — or simply drifting?

Sentiment.

Is capital still flowing in — or quietly stepping back?

These are not predictions.

They are observations.

And observations are the bedrock of discipline.

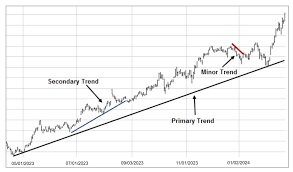

Trend Is the Market’s Honest Voice

Trend has guided traders for more than a century — not because it is clever, but because it is honest.

Trend is commonly measured using moving averages and MACD — tools that smooth noise and reveal direction.

When price begins slipping beneath its averages…

When averages roll over…

When MACD crosses the zero line…

The market is speaking plainly.

It is not angry.

It is not dramatic.

It is simply changing its mind.

And it is inviting you to notice.

The Comfort Warning

There is another signal — quieter, but equally reliable.

It is the moment when your investment feels good.

So good that you speak of it easily.

So good that confidence becomes comfort.

That warm, settled feeling has marked more dangerous ground than any chart ever has.

My best buys usually felt uncertain.

My worst holds usually felt cozy.

The market rewards discipline — not attachment.

Where Profit Is Really Made

There is no perfect signal.

No flawless indicator.

No method that removes uncertainty.

But trend, momentum, and disciplined observation form a compass that quietly protects capital — and lets profit breathe.

You do not make money when you buy.

You make money when you sell —

calmly, carefully, and without emotion.

Let the numbers speak.

Let discipline lead.

And never confuse comfort with safety.

— DenaliGuide

Leave a comment