Self-confidence isn’t something you stumble into. It’s built—deliberately, persistently, and often in quiet struggle. For the investor, self-confidence is not a mood. It’s the result of self-discipline.

Confidence doesn’t magically manifest when the markets are going up or when luck is on your side. It comes from preparation, training, and the disciplined execution of a plan. Through self-discipline, you train your mind and your emotions to stick to your strategy—especially when fear and greed come knocking.

The Timeless Struggle: Fear and Greed

A simile helps us understand this:

“The passions of humankind never change.”

Fear and greed aren’t new. They’re old companions in every trader’s journey. Who doesn’t want to profit? Anyone who says “not me” is being less than honest.

But the investor who thrives is the one who has trained—really trained—to act against those passions.

Take the example of buying low and selling high. It sounds simple. But who among us can confidently buy before the crowd notices, before the stock takes off? Most of us wait until the gain is obvious, missing the opportunity we once planned for.

Standing Your Ground

It’s not so different from facing a bear or a puma in the wild.

If you run, you’ll be caught. But if you stand your ground, you have a fighting chance. So it is in the markets.

Not every trade will be profitable. But if you protect your capital and act according to your plan, you’ll live to trade another day.

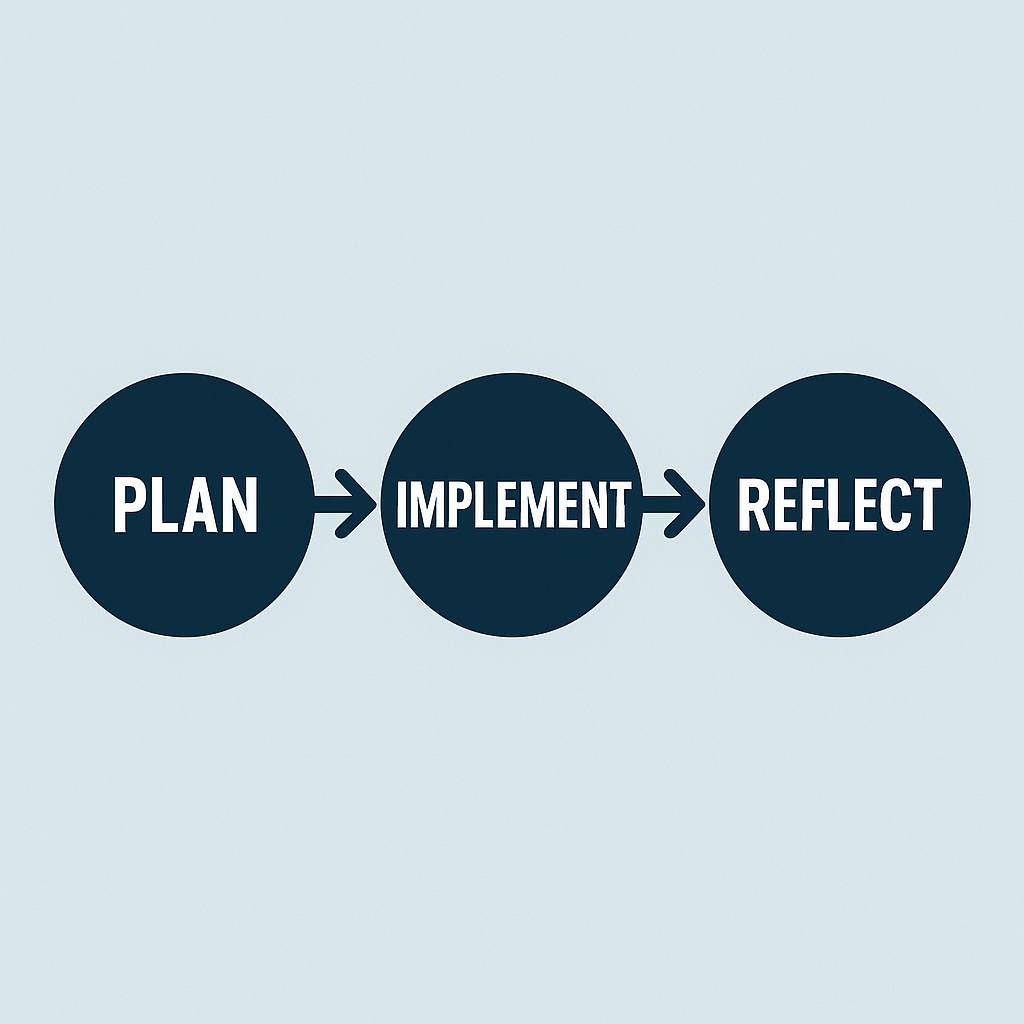

Here’s how that discipline looks in action:

- Create your plan with confidence.

- Implement your plan.

- Stand your ground while it plays out.

- If the trade turns against you—exit. That was planned.

- If the trade works—take profit near the top. That was also planned.

- Repeat, again and again, with discipline.

Each time the market snarls like a predator, you don’t run. You stay calm and follow your training.

Discipline + Training = Confidence

The Hard Truth

Let’s be clear:

- Nothing comes free.

- You must invest part of yourself.

- Every step needs planning.

You wouldn’t turn your back on a wild animal you know can maul you. And you shouldn’t expose your capital to emotional whims. You worked for that money—don’t waste it.

So when a trade turns sour, you follow the plan and take the loss—small and pre-calculated. This is how you stay in the game. This is how you protect the capital that funds your future success.

Hard to Do? Yes.

Discipline is incredibly hard to develop—at first. But with training, it gets easier. Like snuffing out a match with wet fingers, you learn the reflexes that keep you from being burned.

No, taking a loss never feels good. But once you realize it’s necessary, you understand it’s like putting out that match before it lights a fire. It’s part of the process.

The Good Part Isn’t Easy Either

Selling near the top isn’t easy either. Greed whispers, “Just more…”

But often, the regret does not come from losing. It comes from not selling when you should have.

I’ve been there. I’ve felt that heartburn. I’ve stood firm and been rewarded. I’ve also been wrong, and I’ve lost. I’ve been trading, on and off, since 1961. And I’ve danced with that bear more than once.

Risk is real. Loss and gain come in waves. But when you have discipline, you learn to ride those waves without drowning in emotion.

So What Should You Do?

I. Train for the Game.

Plan. Include contingencies. Prepare like a professional.

II. Develop Your Discipline.

Through practice—on paper if necessary—you build the confidence to act when it counts.

III. Start Small, Then Grow.

Discipline and confidence are muscles. Use them, and they grow stronger.

My old boss had a saying (he did quite well—married the boss’s daughter and all):

“Plan your work. Work your plan.”

That hasn’t changed in 60 years. And I doubt it will in the next 60.

“I’ve learned—often the hard way—that discipline isn’t just part of the process, it is the process. And over time, that’s what builds the quiet confidence to keep showing up, plan in hand, ready for whatever comes.” DG

Leave a comment